I was at Sands Theatre the evening before. No, I did not watch Matilda but I was there to fetch my daughter after she watched the show.

I was back again at MBS on 28 March to attend the first AGM for this year, and my first DBS AGM.

I will just briefly share what caught my attention. Remember what I am sharing are already processed by a foggy brain and meshed with my opinions. Hence, take what you read with many pinches of salt.

FY2023 is a particular strong year for the group. It is the first Singapore company that reported net profit beyond $10b! And the growth did not just come from the increase in NIM. Compared to some of the developed countries, Singapore banks’ NIM are below major developed markets.

Do note the data above is average from 2022 to 2021. So Singapore banks did enjoy the NIM boost over the past year but that is not the only factor that resulted in their strong performance.

Another factor that resulted in the impressive results is the increase in customers base in consumer banking by 6 millions to 18 millions! They successfully integrated Citi Taiwan and also experienced strong growth in both India and Indonesia. In response to a question on India, Piyush shared that they are working on SME and consumer banking with the aim of doubling the revenue in the next 5 years and expect the segment to contribute about 250-300 mil of profit.

It is great that this year, Piyush decided to share how DBS has transformed since he took over. That provided me a sense of the good work done by the team over the past decade. The record ROE is attributed to two structural improvements:

- Digital capabilities to capture more foreign deposits

- Increasing contribution from high ROE businesses, are attributed to the the record ROE.

As seen from the trend, the improvement in ROE did not occur overnight. It does seem that the impact is only felt in recent years. I guess what is more important is that they are confident to achieve a ROE for 15-17% in the medium term, with a projected interest rate closer to 3%.

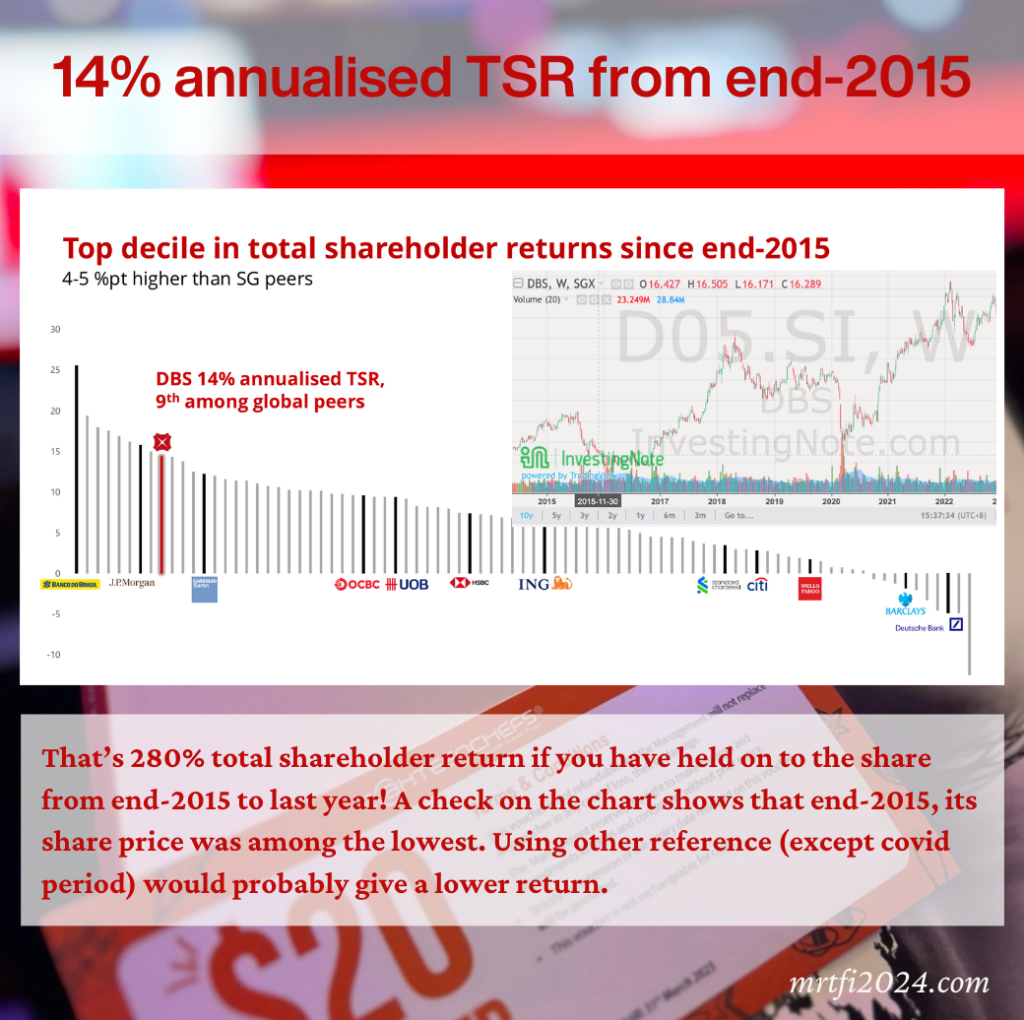

Another interesting share is the total shareholders’ return over the past eight years. If one has held on to DBS shares from end 2015 to now, that would a total of 280% return! Impressive indeed but I am always wary of such comparison as a change in reference date would result in a different number. And indeed, a check on the chart shows that during the period of end 2015 to early 2016, DBS was trading only at around $16. If a different reference (excluding Covid period) is used, then the return would probably still be good but not as impressive.

An overzealous shareholder commented during the session that DBS is even better than the “Magnificent Seven” stocks. He probably does not keep track of these companies or maybe he meant it as a joke! I took a quick look at the charts of the three that I have (nope, unfortunately I didn’t have them since 2015), you can see how wrong this shareholder is.

And the above does not even include Nvidia, which again unfortunately I do not have. I am not saying that DBS is not as good but it is just doesn’t make sense to compare them to the technology companies.

In response to another question from shareholder about DBS trying to be the D of Gandalf (Google, Amazon, Netflix, Apple, LinkedIn and Facebook being the rest), Piyush highlighted that fundamental they are a bank and would not venture into other businesses and is definitely not going to build a rocket. However, they tried to learn from these technology companies on customers acquisition, instant servicing and use of data, which resulted in the bank in pushing to increase their digital capabilities over the years.

Other snippets

With regards to improving technology resilience, my sensing is that effort has been put in and things should become better going forward.

Tough for pure digital banks to be successful in Singapore as bank penetration rate is very high. They found it tough to do it in India too. They believe the better model is to have both physical and digital banking.

The bond duration that the bank hold is only 3-4 years, so they can afford to hold them to maturity. And market value of the bonds have turned positive this year.

The bank do not have have residential mortgage in China. They have been conservative and have not grown their book in China and Hong Kong over the past few years. They are still bullish about Greater Bay Area and having a stake in Shenzhen Rural Commercial Bank will allow them to explore future opportunities.

I left the AGM, impressed by the presentation and responses from both CEO Piyush Gupta and Chairman Peter Seah. And am definitely glad that I made the choice to become a shareholder again.

You can click the links below for more information and coverage of the AGM. Happily’s post on InvestingNote definitely included more details than what I shared above.

- DBS AGM presneation deck and response to submitted questions

- Happily’s coverage of the AGM on InvestingNote

Next up will be UOB AGM on 18 April.