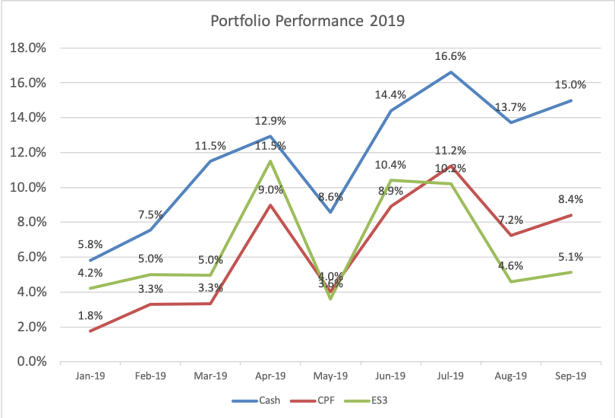

Volatility continues with the escalating US-China trade tension. Despite that, my portfolio managed to eke out a 0.5% gain for the quarter, which means year-to-date performance hit 15.0%. Definitely happy with it as it outpaces ES3’s return of 5.1%.

As for CPF portfolio, it overtook ES3 in July and continues to stay in the lead with a YTD return of 8.4%.

Segment Performance

As seen from the above image, I am ahead of the benchmark in every segment. Let’s hope this will continue be the case for the last quarter. The lead I had over SPY is narrowed, largely due to plunge in Ulta Beauty’s price in August but nonetheless I am happy with the 23.6% return in the US market.

Core Holdings

With the additional purchase of HRnetGroup and Ulta Beauty in August and September respectively, there are now 10 (out of 27) counters in the core holdings and they occupied 56% of the portfolio by cost.

Continuing the trend in the first 2 quarters, my growth counters are struggling and am lucky to have REITs to prop up the numbers.

Top and Bottom 20%

The images below show my top and bottom 6 counters.

A beautiful picture with the top 6 returning at least 30% and much smaller losses from the bottom 6.

What’s Coming Up?

Just subscribed to preferential offer of Keppel DC Reit and will subscribe to MCT’s upcoming PO. Another round of distributions from the REITs is also round the corner and I do not expect any surprises.

Growth counters in core holdings, with the exception of Food Empire should continue to struggle in the near term. I am hopeful that in time to come, they will turn in a better performance.

Pls notify when u hv update

Hi, you can follow the blog and will receive notification for any new post.